2022 Hedge Fund Compensation Report

Over the years, the Report has grown into the most comprehensive, reliable and affordable hedge fund compensation resource on the market.

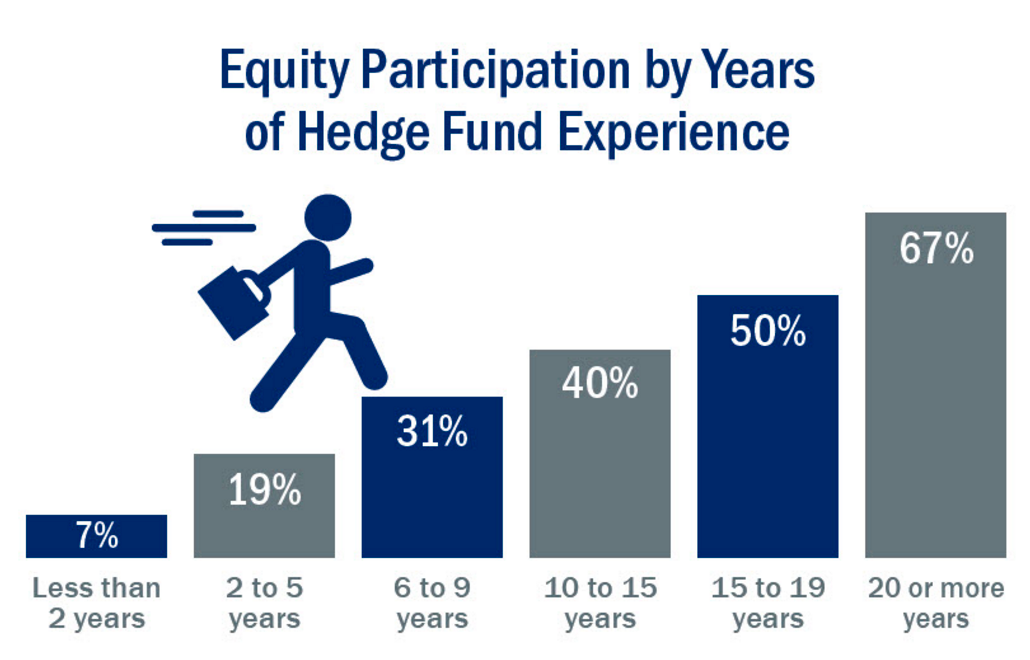

This report analyzes data related to cash compensation earned, levels of equity sharing, work satisfaction and much more. It also seeks to clarify fund performance and how that relates to pay expectations.

Download the Hedge Fund

Compensation Report

Instantly for

only $697

What We Offer

With 50 detailed charts and graphs, we have prepared this report to help you learn about hedge fund compensation practices and benchmark market rate compensation. Some of the data includes:

- Base vs. Bonus – broken out by level of earnings

- Expected Final Compensation This Year vs. Last Year

- Average Compensation by Title

- Cash Compensation by Fund Size for most common titles

- Full table of Earnings by Title (mean and ranges)

- Hours Worked per Week

- Vacation Earned vs. Taken

- Upside Sharing by Title

- And MUCH more!

Try before you buy

Get the Benchmarks

The Report addresses core compensation topics, much more than just cash compensation.

For Your Benefit

This report will give you what you need whether you are negotiating your own compensation package or setting benchmarks for your firm’s compensation policies.

Information = Power

This Report is up-to-date, comprehensive, reasonably priced, and guaranteed. Download your free copy now and you’ll be on your way to more successful compensation policies.

Independent. Comprehensive. Reliable.

“I really enjoyed the report. It was extremely well done and insightful. Thanks again.”

Mark D.“I did find very useful your salary guide – that definitely helped me to negotiate my offer.”

James R., Washington DCI used the Report to benchmark my own compensation vs. the industry.

Principal, Menlo Park, CAThe Hedge Fund Compensation Report has grown to become the most complete benchmark for hedge fund compensation practices in the industry. The Report represents a compensation benchmark resource that is comprehensive, reliable and affordable.

Respondents participating over the years represent a good cross-section of the industry including small firms as well as some of the most recognized hedge fund firms, including:

| • Apollo Global Management | • Bank of America Merrill Lynch |

| • Barclays | • Blackwater Capital |

| • Citi | • Credit Suisse |

| • Deutsche Bank | • Gottex Fund Management |

| • HSBC | • JP Morgan Chase & Co. |

| • LCF Rothschild | • Man Investments |

| • RBC | • Silver Point Capital |

| • UBP Asset Management | • UBS and Wells Fargo Alternative Strategies |

As Seen In

Download the report instantly

Get the most comprehensive benchmark for hedge fund compensation