Trends in Hedge Fund Bonus Pay

One of the hottest topics in hedge fund compensation is bonus pay – who’s getting it, how much they’re getting, does it depend on fund size or fund performance or is it guaranteed? While much of the spotlight is placed on the highest paid superstars, we can answer these important questions for the hedge fund industry as a whole.

The Hedge Fund Compensation Report has collected and reported on data from thousands of hedge fund professionals representing more than 1,000 global firms for the past decade. With this robust real-life database as our foundation, we are in a unique position to illuminate these topics. Here we have analyzed trends over the past five years when it comes to bonus pay in the hedge fund industry.

Question: How much are hedge fund professionals making in bonuses?

Answer: It all depends on how much they make in total.

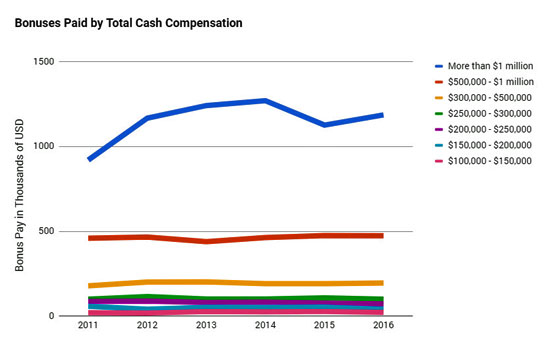

When hedge fund professionals are making more than $1 million annually, most of their compensation comes in the form of bonuses. But, these bonuses are more responsive to market pressures and fund performance.

Between 2011 and 2016, bonuses for those making more than $1 million fluctuated an average of $350,000, between a “low” of $920,000 and a high of $1,270,000. Those making less than $1 million had lower bonus pay, but did not see the same variability.

Between 2011 and 2016, bonuses for those making more than $1 million fluctuated an average of $350,000, between a “low” of $920,000 and a high of $1,270,000. Those making less than $1 million had lower bonus pay, but did not see the same variability.

In July 2013, Bloomberg Businessweek published an article, “Hedge Funds are for Suckers” that predicted lower hedge fund returns and weaker outlooks going forward.

Indeed, the largest one year drop in top tier bonuses was between 2014 and 2015 during a period of hedge fund underperformance. Bonuses at the highest levels ticked up again in 2016, but have not returned to 2014 levels.

Our conclusion? The highest bonuses and greatest upside potential rests with the senior hedge fund professionals who shoulder the bulk of responsibility for overall fund performance. And, while the highest paid make the most in bonuses, they also bear the downside risk of reduced cash compensation in leaner times.

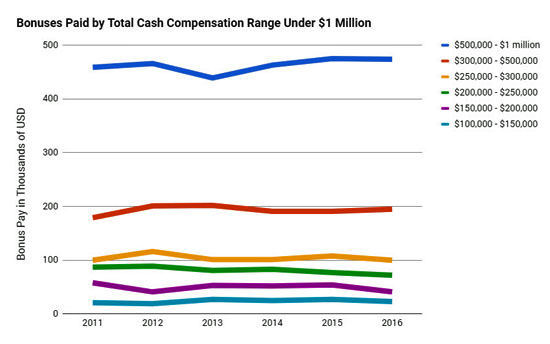

When it comes to those earning less than $1 million, the same rules don’t seem to apply.

Bonuses for those in the lower compensation tiers have remained more consistent over time despite changing market forces. Those making between $500,000 and $1 million can expect to see an average bonus of approximately $193,200. And, those making between $100,000 and $300,000 are making somewhere between $23,700 and $104,300 in bonus pay, on average.

As David Kochanek said when interviewed in January 2017 for the efinancialcareers article, “The Biggest Misconceptions about Working for a Hedge Fund,” it is common to overestimate how much a typical hedge fund professional makes.

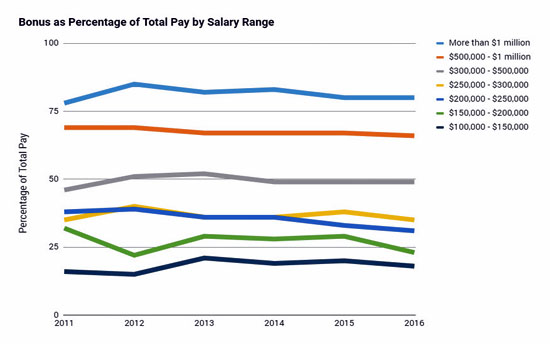

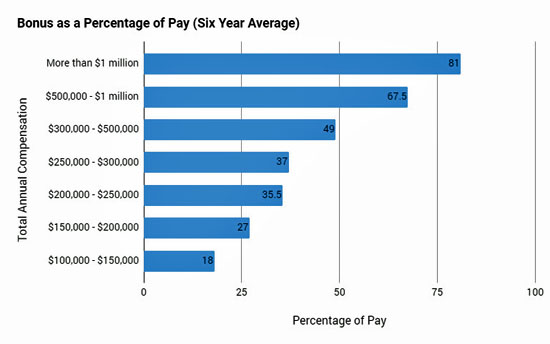

Question: What percentage of total pay does the bonus represent?

Answer: The more you make, the higher percentage of your total compensation comes in the form of bonuses.

Despite some fluctuation, the bonus as a percentage of pay has remained pretty consistent over time. Our data shows hedge fund professionals can expect their bonus to represent essentially the same percentage of their pay over time depending on how much they are compensated in total. The chart below gives these percentages as six-year averages.

Those making more than $1 million annually can expect their bonus to represent approximately 80 percent of their total compensation. At the threshold of more than $300,000, hedge fund professionals can expect at least half of their compensation will come as bonuses.

The majority of hedge fund professionals who make less than $300,000 should expect bonus pay to represent between 18 and 37 of their total annual compensation.

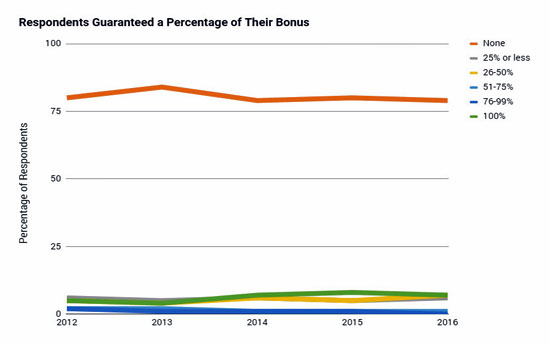

Question: What percentage of hedge fund professionals have a guaranteed bonus?

Answer: Only 20 percent of hedge fund professionals are guaranteed a bonus.

Most hedge fund professionals are not guaranteed a bonus. However, approximately 20 percent of those working in the hedge fund industry have at least a portion of their bonus guaranteed.

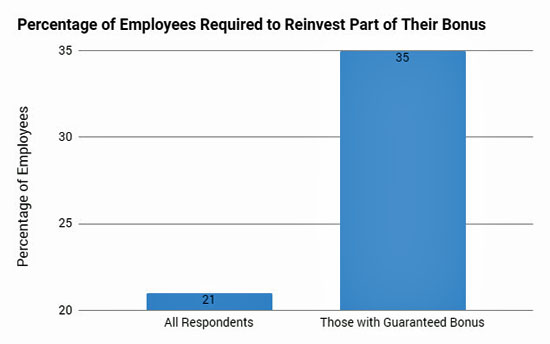

Many of those with guaranteed bonuses are expected to reinvest at least part of their bonus in the fund for which they work. Some employees are required to reinvest a percentage of their bonus back into their firm’s fund, even when none of their bonus is guaranteed.

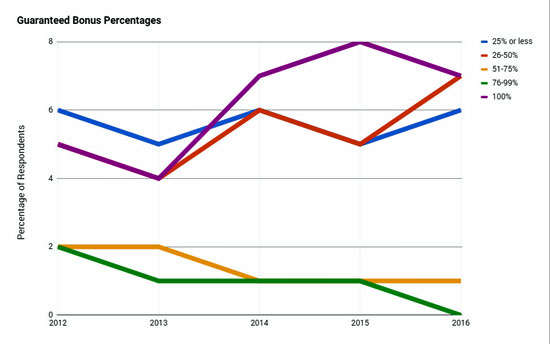

Question: How have guaranteed bonus percentages changed over time?

Answer: Some are up and some are down.

Over the past five years, the percentage of bonus pay guaranteed to hedge fund professionals has fluctuated. And, the results are not necessarily what you would expect.

The percentage of hedge fund professionals who are guaranteed 100 percent of their bonus has moved up from 4 to 5 percent in 2012-2013, to 7 to 8 percent in 2015-2016, despite hedge fund underperformance during this time. Those guaranteed between 26 and 50 percent of their bonus pay also is on the upswing.

Those guaranteed the lowest percentage of their bonus (25 percent or less) has stayed relatively unchanged. And, the percentage of respondents who are guaranteed between 51 and 99 percent of their bonus is down during this timeframe.

While those working in the industry may be interested to learn how much they can expect to make in bonuses on average, lots of other people, including investors, want to know how well these bonuses are tied to the performance of the funds. Here we dig a bit deeper to report on how bonus pay connects to fund performance and fund size.

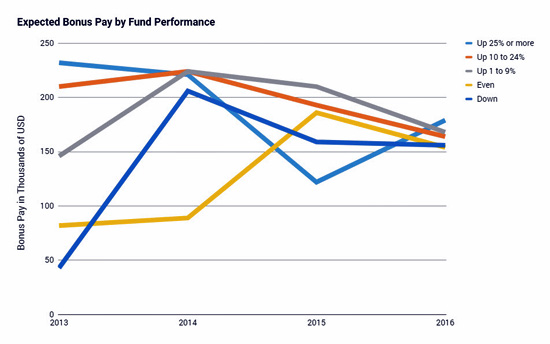

Question: Do hedge fund bonuses depend on the performance of the fund?

Answer: In the past, bonus pay was more dependent on fund performance. Now, bonus amounts are more similar regardless of fund performance.

In 2013, there was more variation in expected bonus pay based on the performance of the hedge fund. Over the past four years, bonus levels have coalesced and are more similar regardless of fund performance. The total amount of bonus pay increased between 2013 and 2014, but has declined every year since then.

In 2014, we saw a reduction in the correlation between fund performance and bonus levels. Funds that were down paid more in bonuses than funds that broke even. And, while funds with even performance earned lower bonuses than their positively performing peers, those with positive performance all generally earned nearly the same bonus levels.

In 2016, we saw evidence that a correlation between fund performance and bonus pay may be returning to the hedge fund industry. Bonus expectations for respondents in firms down or even have declined, and bonus expectations in firms that are up were more closely aligned with performance.

Question: Are hedge fund bonuses connected to market performance overall?

Answer: Yes, and no.

Judging by media coverage of the most highly paid in the hedge fund industry, you might think market performance doesn’t matter when it comes to overall compensation.

As reported by Forbes in the March 2017 article, “The 25 Highest-Earning Hedge Fund Managers And Traders,” last year, “the average hedge fund manager returned 5.6% net of fees last year according to HFR, compared to the 12% return of the U.S. stock market, as measured by the Standard & Poor’s 500 index. Trailing the U.S. stock market has become an annual ritual for most hedge funds.”

Similarly, The New York Times reported in May 2017 in “Hedge Fund Managers Don’t Always Beat the Market, but They Still Make Billions,” that according to Institutional Investor’s Alpha magazine, the top 25 hedge fund managers made a total of $11 billion in 2016, “down from $13 billion the previous year, but still more than double what the top earners made in 2000,” despite earning “single-digit returns for their investors, a lackluster sum in a year when the Standard & Poor’s 500-stock index was up 12 percent.”

But, these “top 25” hedge fund managers represent a very small percentage of those in the industry.

As our data reflects, in recent years and for most in the industry, bonus pay is related to both market returns and fund performance.

That being said, when more hedge fund professionals are given 100 percent bonus guarantees and key players are offered retention bonuses, the link between market performance and bonus pay begins to fray.

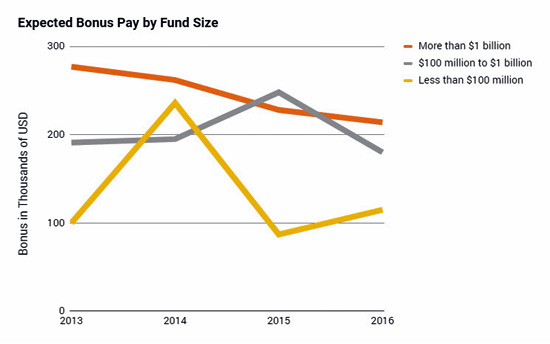

Question: Do hedge fund bonuses vary based on the size of the fund?

Answer: Bonuses at large funds are typically higher, but have been on a steady decline. Bonus pay at small funds fluctuates widely year over year.

Between 2013 and 2016, bonus pay has steadily declined at the largest hedge funds with more than $1 billion assets under management (AUM). Over those four years, bonuses at the largest firms went from an average of $277,000 down to $214,000.

Bonus pay at smaller funds is typically less, and is more variable and volatile. Bonuses at funds with less than $100 million assets under management (AUM), plummeted from an average of $236,000 in 2014 to a low of $87,000 the following year.

In 2016, those at the largest funds could expect bonuses twice that of their counterparts at the smaller funds.

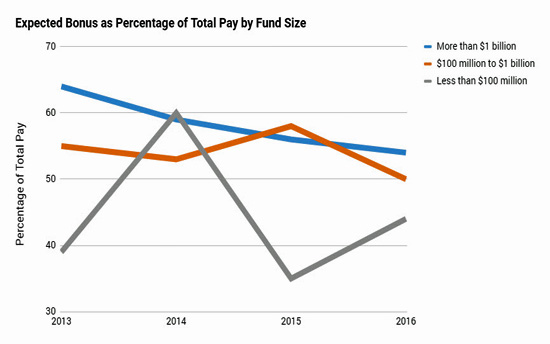

Question: Do bonuses represent different percentages of total pay at different size funds?

Answer: There are significant percentage differences between bonus pay at large funds and small funds.

Between 2013 and 2016, bonus pay as a percentage of total compensation has steadily declined at the largest hedge funds with more than $1 billion assets under management (AUM). Bonus pay at smaller funds is more unpredictable and fluctuates up and down annually.

Last year, on average, bonus pay ranged between 44 percent of pay at the smaller firms to 54 percent of pay at the largest.

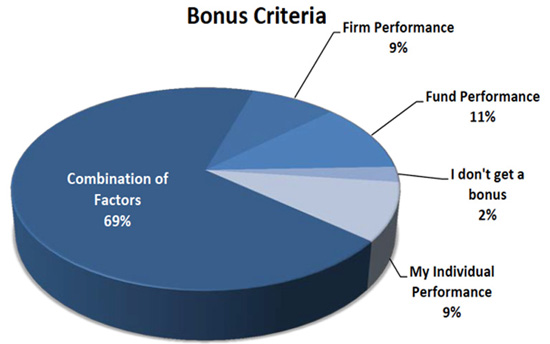

Question: What criteria do hedge funds use to determine bonus pay?

Answer: Not all hedge fund firms use the same bonus criteria.

The majority of hedge fund firms (69 percent) use a combination of criteria to arrive at bonus payouts. These criteria may include firm performance, fund performance and individual performance, as well as other factors.

Last year, bonuses paid based on a “combination of factors” were higher than bonuses tied to one calculation method, such as fund performance. Individual performance and firm performance offered the worst outcomes for bonus recipients in 2015 and 2016. Individual performance was the bonus criterion with the lowest payout.

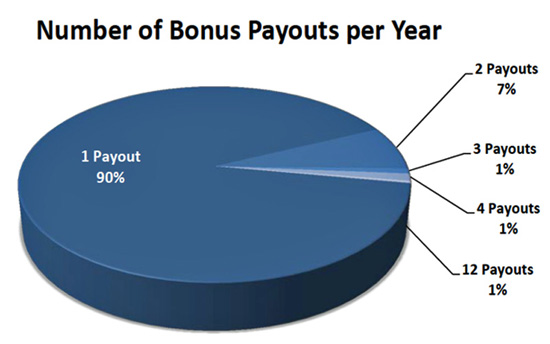

Question: How many times per year are bonus payouts made?

Answer: Typically, once annually.

Almost all hedge fund firms (90 percent) pay one annual bonus.

The expense involved in multiple bonus payouts make this the logical option for the cost-conscious hedge fund industry.

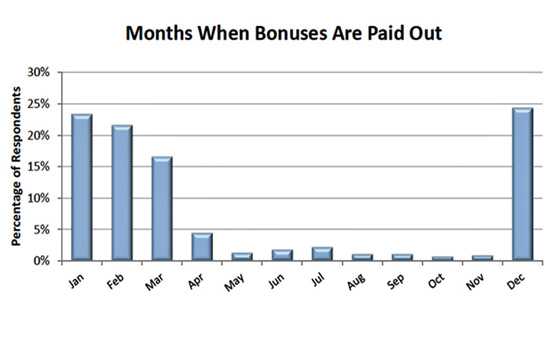

Question: When are bonuses paid out?

Answer: Typically, first quarter or year end.

A majority of our respondents (62 percent), receive their bonus pay in the first quarter of the year.

An additional 24 percent of our respondents receive their bonuses in December, meaning this is the most popular month for bonus pay outs and year end runs a close second when it comes to bonus timing.

When most hedge fund professionals can expect to receive a bonus payout sometime between December and March, it stands to reason that they are less likely to change jobs during this time. Hedge funds looking to recruit key players are better off waiting until the second or third quarters of the year to extend employment offers when bonus pay is less likely to be part of the equation.

The Hedge Fund Compensation Report is the most comprehensive, reliable and affordable hedge fund compensation resource on the market. This year’s report includes 50 detailed charts and graphs to answer your compensation questions with industry data