The hedge fund industry has a reputation of being comprised of firms that are smaller and more nimble than their traditional asset management peers. Our 2015 Hedge Fund Compensation Report survey results found this to be true, with 70 percent of respondents indicating that they work for a firm with less than 100 employees.

While it is true that in good times hedge funds can earn considerably higher fees due to their performance fee models, it doesn’t necessarily mean that these same funds can employ a large number of professionals with a large payroll. Markets are inherently volatile, and when a large portion of your fee revenue is driven by performance, hedge funds require lean operating expenses in order to survive downturns and weaker markets.

Hedge funds are also run more entrepreneurially than many traditional asset managers, with founders and some investors directly involved the day-to-day business. The direct involvement and control of the firm’s ownership may also be a contributing factor when it comes to reduced headcount and efficient, lean operations.

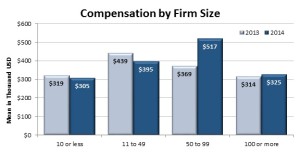

When it comes to hedge fund professionals, however, many want to know whether working at the largest firms or a small upstart operation offers the greatest compensation. What our survey found is that neither extreme is best for a professional looking for the highest pay package. Those respondents from firms in the middle two size ranges indicated they had the highest total earnings in 2014, a trend maintained from the prior year as well. Further, those in firms with 50 to 99 employees saw the strongest year over year earnings growth as well. This suggests that these middle sized firms may be the most ideal place to work if you’re seeking out the highest possible pay.

With that considered, smaller and larger firms also offer some advantages. A smaller firm will allow a professional to be exposed to a wider variety of responsibilities within each role, and may offer greater direct interaction with senior managers and potentially investors. On the other hand, a larger firm can offer greater stability and the ability to specialize further in a specific role or responsibility. The optimal firm size for a financial professional likely depends more on future career direction and desired experience than on seeking out the highest pay package.

In any event, hedge funds of all sizes offer excellent compensation prospects for financial professionals. With year over year growth in compensation at over 12 percent in 2014, the future remains positive for the industry as a whole, regardless of how many professionals are in your firm or group.