In nearly all segments of the financial industry, bonuses tend to comprise a higher percentage of total compensation, especially compared to the general population. The hedge fund industry in particular is no different, with bonuses comprising a large percentage of a professional’s total pay. And while it should come as no surprise that those at the top of the earnings spectrum earn the highest bonuses in nominal dollars, their bonuses as a percentage of compensation is often a multiple of their lesser earning peers.

While bonuses at the highest level have been extremely healthy over the last several years, with those at the top of the income spectrum earning five times their base salary in bonus pay. In 2014, however, our 2015 Hedge Fund Compensation Report survey found a slight moderation in the bonuses received by the highest earning hedge fund professionals. Last year, on average, those earning more than one million dollars per year earned only four and half times their base salary in bonuses. While base salaries rose to offset this somewhat, total compensation was much reduced in 2015 for those at the highest income level.

In most cases, bonuses are dependent on both firm and individual performance. This serves two main purposes. First, it provides an incentive to positively influence returns for both the fund and investors. In addition, it provides the firm with a variable expense item that can help the firm adapt to reduced fee revenue in times of lower performance. This is particularly important in the hedge fund industry where performance fees comprise a large portion of most firm’s income, rather than just the typical percentage of assets under management (AUM) fee charged by many traditional money managers. Hedge funds can often be hit on two fronts, with lower performance fees and reduced AUM fees when their results are poor. The flexibility of having a large portion of compensation allocated to bonuses helps manage this variable income for the firm.

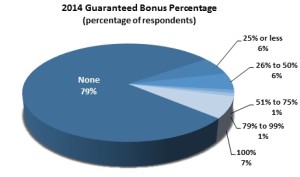

Our survey reflects this reality, indicating that for the vast majority of hedge fund professionals, no portion of their bonus is guaranteed. This year, 79 percent of respondents indicated that none of their incentive pay was certain, just down slightly from the prior year.

Bonuses will always be a major piece of hedge fund compensation, given the nature of the fee structure of the business and the strong motivation to align employee performance with shareholder objectives. This performance alignment suggests that if results are improved in 2015, we’d expect an uptick in compensation coming from bonuses, especially for those at the highest levels of the firm.